Q1 2024 GROUP ADJUSTED EBITDA OF $2.8 BILLION,

UP 49% YEAR-ON-YEAR, UP 1% QUARTER-ON-QUARTER

ANNOUNCED THE BRANDING OF CAPELLA AT GALAXY MACAU

PAID A SPECIAL DIVIDEND OF $0.30 PER SHARE ON 26 APRIL 2024

HONG KONG, May 14, 2024 (GLOBE NEWSWIRE) - Galaxy Entertainment Group (“GEG”, “Company” or the “Group”) (HKEx stock code: 27) today reported results for the three-month period ended 31 March 2024. (All amounts are expressed in Hong Kong dollars unless otherwise stated)

Dr. Lui Che Woo, Chairman of GEG said:

“Thank you for the opportunity to provide you with a broad market overview and a review of the financial performance of GEG in Q1 2024. During Q1 2024, we made substantial adjustments to Galaxy MacauTM's gaming floor, in the shorter term this was disruptive for the month of January and the early part of February. The renovation was completed just prior to Chinese New Year. With the completion of this renovation, we have seen a significant improvement in the flow of customer traffic across the entire floor.

Across our portfolio, we are in the process of implementing smart tables which will drive further efficiency across the gaming floor. Additionally, we are updating our slot machine products and we are working on a range of upgrades to StarWorld Macau.

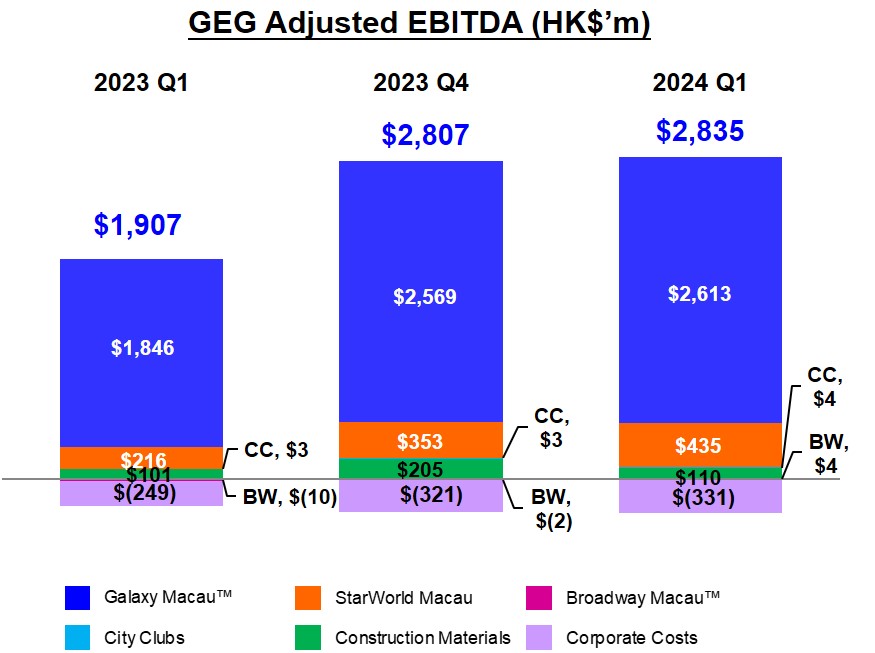

Moving onto our financial performance, the Group Net Revenue in Q1 2024 was $10.6 billion, up 50% year-on-year and up 2% quarter-on-quarter; Adjusted EBITDA was $2.8 billion, up 49% year-on-year and up 1% quarter-on-quarter. We were particularly encouraged with our casino performance over the May Golden Week and post the reconfiguration of Galaxy MacauTM's gaming floor.

Our balance sheet remained healthy and liquid. As of Q1 2024, cash and liquid investments were $26.4 billion and the net position was $25.0 billion after debt of $1.4 billion. We recently paid the previously announced special dividend of $0.30 per share on 26 April 2024.

We were pleased to announce the addition of the Group's tenth hotel brand – Capella Hotels and Resorts. The 17-storey Capella at Galaxy Macau is expected to open in mid-2025 and offers approximately 100 ultra-luxury sky villas and suites. This represents our continued commitment to delivering unparalleled experiential luxury to our guests in Macau and supporting the Government's vision to develop Macau into the World Centre of Tourism and Leisure.

We are very pleased to welcome the 75th anniversary of the founding of the People's Republic of China and the 25th anniversary of Macau's return to the Motherland this year. We hope that the industry will continue to receive the full support of the Central Government and the Macau SAR Government. As always GEG will support these important milestones with a range of supportive promotional activities and events. And we are pleased to see that all those new initiatives on expanding Individual Visit Scheme (IVS) and visa policies may increase tourism to Macau.

Finally, I would like to thank all our team members who deliver ‘World Class, Asian Heart' service each and every day and contribute to the success of the Group.”

Q1 2024 RESULTS HIGHLIGHTS

GEG: Well Positioned for Future Growth

- Q1 Group Net Revenue of $10.6 billion, up 50% year-on-year and up 2% quarter-on-quarter

- Q1 Group Adjusted EBITDA of $2.8 billion, up 49% year-on-year and up 1% quarter-on-quarter

- Played lucky which increased Adjusted EBITDA by approximately $63 million, normalized Adjusted EBITDA of $2.8 billion, up 50% year-on-year and down 5% quarter-on-quarter

- Latest twelve months Adjusted EBITDA of $10.9 billion, up 1,297% year-on-year and up 9% quarter-on-quarter

Galaxy MacauTM: Well Positioned for Future Growth

- Q1 Net Revenue of $8.3 billion, up 55% year-on-year and up 2% quarter-on-quarter

- Q1 Adjusted EBITDA of $2.6 billion, up 42% year-on-year and up 2% quarter-on-quarter

- Played lucky which increased Adjusted EBITDA by approximately $48 million, normalized Adjusted EBITDA of $2.6 billion, up 44% year-on-year, and down 4% quarter-on-quarter

- Hotel occupancy for Q1 across the seven hotels was 97%

StarWorld Macau: Well Positioned for Future Growth

- Q1 Net Revenue of $1.4 billion, up 46% year-on-year and up 9% quarter-on-quarter

- Q1 Adjusted EBITDA of $435 million, up 101% year-on-year and up 23% quarter-on-quarter

- Played lucky which increased Adjusted EBITDA by approximately $15 million, normalized Adjusted EBITDA of $420 million, up 94% year-on-year, and up 20% quarter-on-quarter

- Hotel occupancy for Q1 was 100%

Broadway Macau™, City Clubs and Construction Materials Division (“CMD”)

- Broadway Macau™: Q1 Adjusted EBITDA was $4 million, versus $(10) million in Q1 2023 and $(2) million in Q4 2023

- City Clubs: Q1 Adjusted EBITDA was $4 million, up 33% year-on-year and up 33% quarter-on-quarter

- CMD: Q1 Adjusted EBITDA was $110 million, up 9% year-on-year and down 46% quarter-on-quarter

Balance Sheet: Healthy and Liquid Balance Sheet

- As at 31 March 2024, cash and liquid investments were $26.4 billion and the net position was $25.0 billion after debt of $1.4 billion

- Paid a special dividend of $0.30 per share on 26 April 2024

Development Update: Opening Capella at Galaxy Macau in mid-2025; Ramping up GICC, Galaxy Arena, Raffles at Galaxy Macau and Andaz Macau; Progressing with Phase 4

- Announced the opening of Capella at Galaxy Macau in mid-2025

- Cotai Phase 3 – Ramping up GICC, Galaxy Arena, Raffles at Galaxy Macau and Andaz Macau

- Cotai Phase 4 – Our efforts are firmly focused on the development of Phase 4. Phase 4 has a strong focus on non-gaming, primarily targeting MICE, entertainment, family facilities and also includes gaming

Macau Market Overview

Based on DICJ reporting, Macau's GGR for Q1 2024 was $55.7 billion, up 65% year-on-year and up 6% quarter-on-quarter. In Q1 2024, visitor arrivals to Macau were 8.9 million, up 79% year-on-year, recovering to 86% in the same quarter of 2019. Overnight visitors were 4.1 million, up 55% year-on-year. Mainland visitor arrivals were 6.3 million, up 94% year-on-year. 55% of the Mainland visitors were from the IVS. The Central Government continues to strongly support Macau this is evidenced by the recent expansion of the existing IVS to include an additional 10 cities. This brings the total number of Chinese cities under the IVS to 59 cities, with a combined total population of over 490 million.

Further, The National Immigration Administration of China introduced new measures for Mainlanders including residents from 20 large cities to be able to update or reissue their travel documents entirely online, Mainlanders who participate in exhibitions or art performances can apply “other” visa type for multiple-entry visits to Macau for one year, and multi-entry tour visas within 7 days for Mainlanders who participated in Hengqin-Macau group tours. These new measures were effective from 6 May 2024.

Group Financial Results

In Q1 2024, the Group posted Net Revenue of $10.6 billion, up 50% year-on-year and up 2% quarter-on-quarter. Group Adjusted EBITDA was $2.8 billion, up 49% year-on-year and up 1% quarter-on-quarter. Latest twelve months Adjusted EBITDA of $10.9 billion, up 1,297% year-on-year and up 9% quarter-on-quarter.

In Q1 2024, GEG played lucky in its gaming operation which increased its Adjusted EBITDA by approximately $63 million. Normalized Adjusted EBITDA was $2.8 billion, up 50% year-on-year and down 5% quarter-on-quarter.

Summary Table of GEG Q1 2024 Adjusted EBITDA and Adjustments:

| in HK$'m | Q1 2023 | Q4 2023 | Q1 2024 | YoY | QoQ | ||

| Adjusted EBITDA | 1,907 | 2,807 | 2,835 | 49% | 1% | ||

| Luck1 | 59 | (103) | 63 | - | - | ||

| Normalized Adjusted EBITDA | 1,848 | 2,910 | 2,772 | 50% | -5% | ||

The Group's total GGR in Q1 2024 was $9.6 billion, up 59% year-on-year and up 4% quarter-on-quarter. Mass GGR was $7.7 billion, up 57% year-on-year and down 1% quarter-on-quarter. Rolling chip GGR was $1.3 billion, up 64% year-on-year and up 43% quarter-on-quarter. Electronic GGR was $600 million, up 78% year-on-year and up 18% quarter-on-quarter.

| Group Key Financial Data | |||

| (HK$'m) | |||

| Q1 2023 | Q4 2023 | Q1 2024 | |

| Revenues: | |||

| Net Gaming | 5,323 | 7,961 | 8,181 |

| Non-gaming | 1,033 | 1,580 | 1,606 |

| Construction Materials | 698 | 778 | 765 |

| Total Net Revenue | 7,054 | 10,319 | 10,552 |

| Adjusted EBITDA | 1,907 | 2,807 | 2,835 |

| Gaming Statistics2 | |||

| (HK$'m) | |||

| Q1 2023 | Q4 2023 | Q1 2024 | |

| Rolling Chip Volume3 | 21,548 | 34,599 | 38,457 |

| Win Rate % | 3.7% | 2.6% | 3.4% |

| Win | 794 | 909 | 1,299 |

| Mass Table Drop4 | 20,675 | 30,696 | 31,471 |

| Win Rate % | 23.9% | 25.5% | 24.6% |

| Win | 4,934 | 7,826 | 7,728 |

| Electronic Gaming Volume | 8,576 | 16,383 | 19,043 |

| Win Rate % | 3.9% | 3.1% | 3.1% |

| Win | 337 | 508 | 600 |

| Total GGR Win5 | 6,065 | 9,243 | 9,627 |

Balance Sheet and Dividend

The Group's balance sheet remains healthy and liquid. As of 31 March 2024, cash and liquid investments were $26.4 billion and the net position was $25.0 billion after debt of $1.4 billion. This provides us with valuable flexibility in managing our ongoing operations and allows us to continue investing in our longer-term development plans. The Group paid a special dividend of $0.30 per share on 26 April 2024.

Galaxy Macau™

Galaxy Macau™ is the primary contributor to Group revenue and earnings. In Q1 2024, Galaxy Macau™'s Net Revenue was $8.3 billion, up 55% year-on-year and up 2% quarter-on-quarter. Adjusted EBITDA was $2.6 billion, up 42% year-on-year and up 2% quarter-on-quarter. Adjusted EBITDA margin was 31% (Q1 2023: 35%).

Galaxy Macau™ played lucky in its gaming operations which increased its Adjusted EBITDA by approximately $48 million. Normalized Q1 2024 Adjusted EBITDA was $2.6 billion, up 44% year-on-year and down 4% quarter-on-quarter.

The combined seven hotels occupancy was 97% for Q1 2024.

| Galaxy Macau™ Key Financial Data | |||

| (HK$'m) | |||

| Q1 2023 | Q4 2023 | Q1 2024 | |

| Revenues: | |||

| Net Gaming | 4,442 | 6,781 | 6,887 |

| Hotel / F&B / Others | 470 | 1,046 | 1,056 |

| Mall | 436 | 364 | 371 |

| Total Net Revenue | 5,348 | 8,191 | 8,314 |

| Adjusted EBITDA | 1,846 | 2,569 | 2,613 |

| Adjusted EBITDA Margin | 35% | 31% | 31% |

| Gaming Statistics6 | |||

| (HK$'m) | |||

| Q1 2023 | Q4 2023 | Q1 2024 | |

| Rolling Chip Volume7 | 21,548 | 33,874 | 37,433 |

| Win Rate % | 3.7% | 2.6% | 3.3% |

| Win | 794 | 880 | 1,243 |

| Mass Table Drop8 | 15,124 | 23,692 | 24,472 |

| Win Rate % | 26.2% | 27.7% | 26.2% |

| Win | 3,970 | 6,570 | 6,406 |

| Electronic Gaming Volume | 6,290 | 10,650 | 12,779 |

| Win Rate % | 4.6% | 3.9% | 3.8% |

| Win | 291 | 418 | 487 |

| Total GGR Win | 5,055 | 7,868 | 8,136 |

StarWorld Macau

In Q1 2024, StarWorld Macau's Net Revenue was $1.4 billion, up 46% year-on-year and up 9% quarter-on-quarter. Adjusted EBITDA was $435 million, up 101% year-on-year and up 23% quarter-on-quarter. Adjusted EBITDA margin was 32% (Q1 2023: 23%).

StarWorld Macau played lucky in its gaming operations which increased its Adjusted EBITDA by approximately $15 million. Normalized Q1 2024 Adjusted EBITDA was $420 million, up 94% year-on-year and up 20% quarter-on-quarter.

Hotel occupancy was 100% for Q1 2024.

| StarWorld Macau Key Financial Data | |||

| (HK$'m) | |||

| Q1 2023 | Q4 2023 | Q1 2024 | |

| Revenues: | |||

| Net Gaming | 828 | 1,122 | 1,235 |

| Hotel / F&B / Others | 105 | 127 | 128 |

| Mall | 5 | 6 | 6 |

| Total Net Revenue | 938 | 1,255 | 1,369 |

| Adjusted EBITDA | 216 | 353 | 435 |

| Adjusted EBITDA Margin | 23% | 28% | 32% |

| Gaming Statistics9 | |||

| (HK$'m) | |||

| Q1 2023 | Q4 2023 | Q1 2024 | |

| Rolling Chip Volume10 | NIL | 725 | 1,024 |

| Win Rate % | NIL | 4.0% | 5.5% |

| Win | NIL | 29 | 56 |

| Mass Table Drop11 | 5,289 | 6,748 | 6,756 |

| Win Rate % | 17.5% | 18.0% | 19.0% |

| Win | 926 | 1,217 | 1,283 |

| Electronic Gaming Volume | 1,406 | 4,533 | 5,045 |

| Win Rate % | 2.3% | 1.6% | 1.8% |

| Win | 32 | 72 | 93 |

| Total GGR Win | 958 | 1,318 | 1,432 |

Broadway Macau™

Broadway Macau™ is a unique family friendly, street entertainment and food resort supported by Macau SMEs. In Q1 2024, Broadway Macau™'s Net Revenue was $46 million, up 156% year-on-year, up 21% quarter-on-quarter this follows the reopening of Broadway Hotel. Adjusted EBITDA was $4 million, versus $(10) million in Q1 2023 and $(2) million in Q4 2023.

City Clubs

In Q1 2024, City Clubs' Net Revenue was $58 million, up 12% year-on-year and up 2% quarter-on-quarter. Adjusted EBITDA was $4 million, up 33% year-on-year and up 33% quarter-on-quarter.

Construction Materials Division (“CMD”)

In Q1 2024, CMD was seasonally impacted by Chinese New Year, where many construction workers travel to their home province resulting in the seasonal shutdown of construction sites. For the quarter, CMD delivered Adjusted EBITDA of $110 million, up 9% year-on-year and down 46% quarter-on-quarter.

Development Update

Galaxy Macau™ and StarWorld Macau

We continue to make ongoing progressive enhancements to our resorts to ensure that they remain competitive and appealing to our guests with a particular focus on adding new and innovative F&B and retail offerings.

At StarWorld Macau we are evaluating a range of major upgrades, that includes the main gaming floor, the lobby arrival experience and increasing the F&B options.

Cotai – The Next Chapter

We are pleased to announce the opening of Capella at Galaxy Macau in mid-2025. The 17-storey hotel offers approximately 100 ultra-luxury sky villas and suites. Each Sky Villa features a light-filled balcony with a transparent infinity-edge pool, outdoor lounge, sunroom and hidden winter garden, among others. Capella at Galaxy Macau promises to bring a new level of elegant luxury to Macau.

We were ramping up GICC, Galaxy Arena, Raffles at Galaxy Macau and Andaz Macau. We are now firmly focused on the development of Phase 4, which is already well under way. Phase 4 will include multiple high-end hotel brands new to Macau, together with a 4000-seat theater, extensive F&B, retail, non-gaming amenities, landscaping, a water resort deck and a casino. Phase 4 is approximately 600,000 square meters of development and is scheduled to complete in 2027. We will continue to adjust the development timeline in accordance with the market demand. We remain highly confident about the future of Macau where Phases 3 & 4 will support Macau's vision of becoming a World Centre of Tourism and Leisure.

Selected Major Awards in Q1 2024

| AWARD | PRESENTER |

| GEG | |

| Sustainability Award | International Gaming Awards 2024 |

| GALAXY MACAUTM | |

MICHELIN One-Star Restaurant

|

The MICHELIN Guide Hong Kong Macau 2024 |

| One Diamond – 8½ Otto e Mezzo BOMBANA | Black Pearl Restaurant Guide 2024 |

| Best Trendy Hotel – Andaz Macau Best Luxury Hotel – Raffles at Galaxy Macau |

The Bund Design Hotel Awards |

| The Most Anticipated New Hotel of the Year – Andaz Macau Luxury Hotel of the Year – Raffles at Galaxy Macau |

HotelShare Media |

| Newly Opened Hotel of the Year – Andaz Macau | First Journey Media |

Five Star Hotel

|

2024 Forbes Travel Guide |

| Best Hotel Spa – Banyan Tree Spa Macau | Vogue Beauty Awards 2024 |

SCMP 100 Top Tables 2024 Award

|

South China Morning Post |

| STARWORLD MACAU | |

| MICHELIN Two-Star Restaurant – Feng Wei Ju | The MICHELIN Guide Hong Kong Macau 2024 |

| One Diamond – Feng Wei Ju | Black Pearl Restaurant Guide 2024 |

| SCMP 100 Top Tables 2024 Award – Feng Wei Ju | South China Morning Post |

| CMD | |

| Caring Company Scheme – 20 Years Plus Caring Company Logo | The Hong Kong Council of Social Service |

Outlook

During 2024 Macau has continued to experience an ongoing recovery with both growth in visitor numbers and associated revenues. The recovery has been predominately led by the premium segment. We still see pent up demand from Mainland, particularity for tourism, leisure and travel and Macau remains one of the top choices for travel destinations by Mainland Chinese.

The Central Government continues to strongly support Macau this is evidenced by the recent expansion of the existing IVS to include an additional 10 cities. This brings the total number of Chinese cities under the IVS to 59 cities, with a combined total population of over 490 million.

Further, The National Immigration Administration of China introduced new measures for Mainlanders including residents from 20 large cities to be able to update or reissue their travel documents entirely online, Mainlanders who participate in exhibitions or art performances can apply “other” visa type for multiple-entry visits to Macau for one year, and multi-entry tour visas within 7 days for Mainlanders who participated in Hengqin-Macau group tours. These new measures were effective from 6 May 2024.

Infrastructure to both access Macau and to move throughout Macau continues to improve. In February the Jinhai Avenue Bridge and Zhuhai Urban-Airport Intercity Railway Phase 2 were officially opened. This is a new bridge that directly connect the Zhuhai airport to Hengqin Island and allows cars and trains to travel from the Zhuhai airport to Hengqin in about 15 minutes.

The Zhuhai airport connects to 50 plus cities in China and will have a capacity of 27.5 million passengers when terminal 2 is completed this year. In comparison, the Macau airport connects to 48 cities in China and has a capacity of 10 million passengers. Within Macau the fourth cross-harbor bridge is expected to open later this year and connects the peninsula to Cotai which will allow easier travel within Macau.

The Macau Government through its tourism authority in combination with the six concessionaires continues to actively promote Macau both within Mainland China and Asia. To support these initiatives GEG has opened overseas business development offices in Tokyo and Seoul and is soon to open an office in Bangkok. This is in-line with our commitment to the Government to further increase the number and flow of high value international visitors to Macau.

We continue to ramp up the newly opened Phase 3 development with a particular focus on events and entertainment shows. The development of Phase 4 continues and will greatly expand our capacity within Macau. We continue to remain confident in the outlook for Macau and are committed to supporting the Macau Government's vision to develop Macau into the World Centre of Tourism and Leisure.

About Galaxy Entertainment Group (HKEx stock code: 27)

Galaxy Entertainment Group Limited (“GEG” or the “Company”) and its subsidiaries (“GEG” or the “Group”) is one of the world's leading resorts, hospitality and gaming companies. The Group primarily develops and operates a large portfolio of integrated resort, retail, dining, hotel and gaming facilities in Macau. GEG is listed on the Hong Kong Stock Exchange and is a constituent stock of the Hang Seng Index.

GEG through its subsidiary, Galaxy Casino S.A., is one of the three original concessionaires in Macau when the gaming industry was liberalized in 2002. In 2022, GEG was awarded a new gaming concession valid from January 1, 2023, to December 31, 2032. GEG has a successful track record of delivering innovative, spectacular and award-winning properties, products and services, underpinned by a “World Class, Asian Heart” service philosophy, that has enabled it to consistently outperform the market in Macau.

The Group operates three flagship destinations in Macau: on Cotai, Galaxy Macau™, one of the world's largest integrated destination resorts, and the adjoining Broadway Macau™, a unique landmark entertainment and food street destination; and on the Peninsula, StarWorld Macau, an award-winning premium property.

The Group has the largest development pipeline of any concessionaire in Macau. When The Next Chapter of its Cotai development is completed, GEG's resorts footprint on Cotai will be more than 2 million square meters, making the resorts, entertainment and MICE precinct one of the largest and most diverse integrated destinations in the world. GEG is also progressing plans for its Hengqin project and we are also expanding our focus beyond Hengqin and Macau to potentially include opportunities within the rapidly expanding Greater Bay Area. These projects will help GEG develop and support Macau in its vision of becoming a World Centre of Tourism and Leisure.

In July 2015, GEG made a strategic investment in Société Anonyme des Bains de Mer et du Cercle des Étrangers à Monaco (“Monte-Carlo SBM”), a world renowned owner and operator of iconic luxury hotels and resorts in the Principality of Monaco. GEG continues to explore a range of international development opportunities with Monte-Carlo SBM.

GEG is committed to delivering world class unique experiences to its guests and building a sustainable future for the communities in which it operates. For more information about the Group, please visit www.galaxyentertainment.com

_____________________________

1 Reflects luck adjustments associated with our rolling chip program.

2 Gaming statistics are presented before deducting commission and incentives.

3 Represents sum of junket VIP and inhouse premium direct.

4 Mass table drop includes the amount of table drop plus cash chips purchased at the cage.

5 Total GGR win includes gaming win from City Clubs.

6 Gaming statistics are presented before deducting commission and incentives.

7 Represents sum of junket VIP and inhouse premium direct.

8 Mass table drop includes the amount of table drop plus cash chips purchased at the cage.

9 Gaming statistics are presented before deducting commission and incentives.

10 Represents inhouse premium direct.

11 Mass table drop includes the amount of table drop plus cash chips purchased at the cage.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/8d51506d-da5a-47fc-9a73-4352f900e65a

For Media Enquiries:

Galaxy Entertainment Group - Investor Relations

Mr. Peter J. Caveny / Ms. Yoko Ku / Ms. Joyce Fung

Tel: +852 3150 1111 / Email: ir@galaxyentertainment.com